Acquiring Bank Issuing Bank

What is an acquiring bank.

Acquiring bank issuing bank. Issuing bank in short an issuing bank is the credit card holders bank and the acquiring bank is the merchant or businesss bank. The best known credit card associations are visa mastercard discover china unionpay american express diners club japan. Furthermore you might also want to know more about its counterpart the issuing bank. So read on to learn more about the biggest players in ecommerce including the biggest card networks visa mastercard.

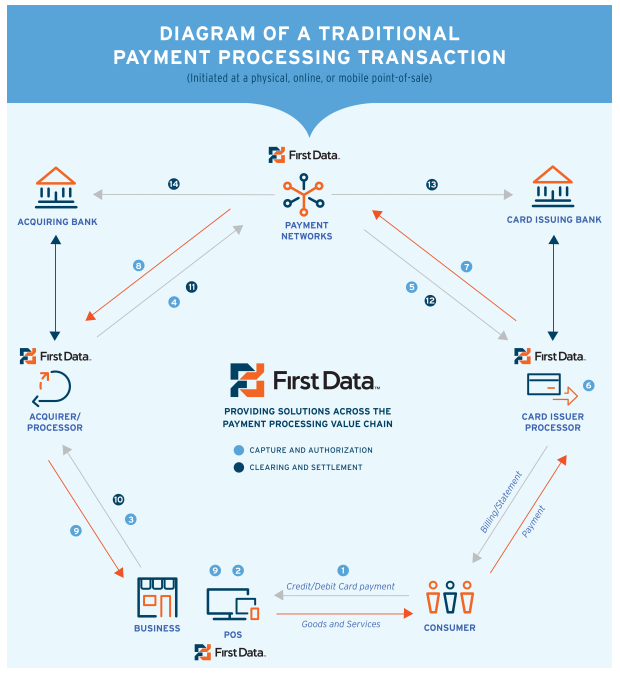

Acquiring bank haendlerbank die acquiring bank des haendlers prueft in echtzeit beim kreditkartenunternehmen die berechtigung laesst sich von der bank des kunden issuing bank den betrag ueberweisen und schreibt dem haendler in regelmaessigen abstaenden alle zahlungsbetraege auf seinem konto gut. Acquiring banks are banks that work with merchants and. An acquiring bank is a financial institution that accepts processes and assumes financial responsibility for payment card transactions on behalf of merchants. Understanding the differences between acquiring banks and issuing banks is important for merchants.

Now lets get specific. Issuing bank the connection in the payment process. Die beiden partner sind fuer ein funktionierendes kartengeschaeft gleichermassen wichtig da sie die entsprechende infrastruktur bereitstellen. While both are part of the chargeback process acquirers and issuers have very different roles.

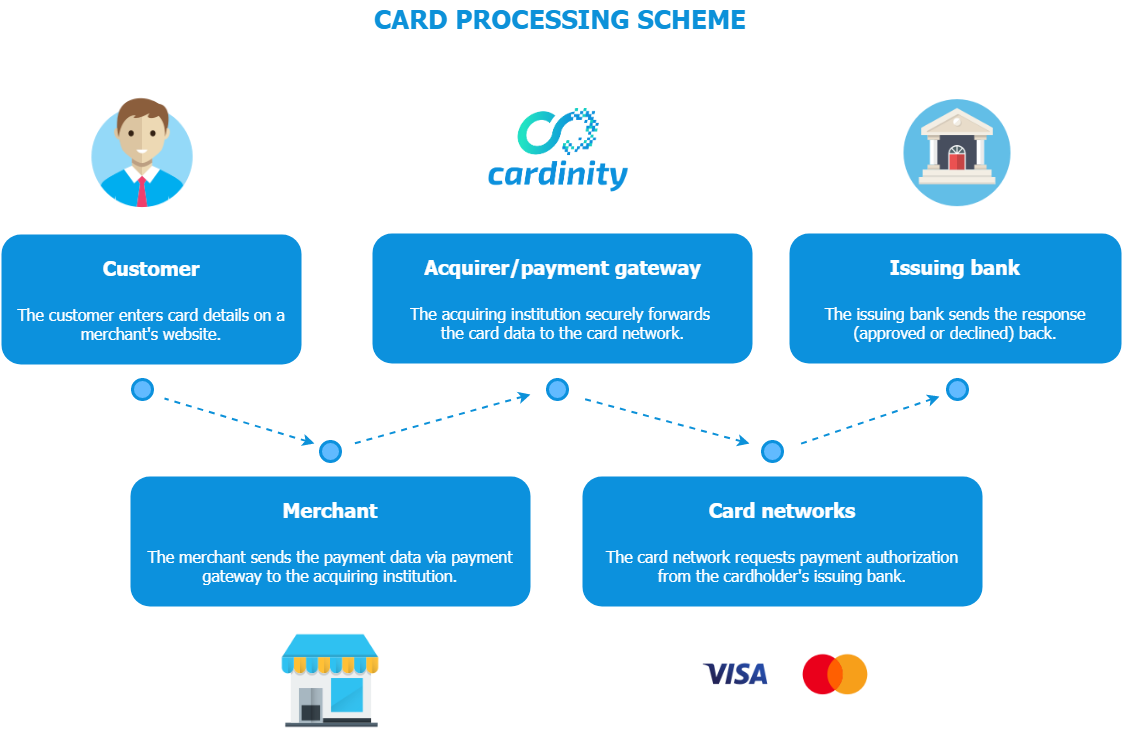

The contract with the acquirer enables merchants to process credit and debit card transactions. The acquiring bank passes the merchants transactions along to the applicable issuing banks to receive payment. Its role as. Die issuing bank uebernimmt die abwicklung auf kundenseite waehrend die acquiring bank die kartenakzeptanz und zahlungsabwicklung auf haendlerseite uebernimmt.

The acquirer allows merchants to accept credit card payments from the card issuing banks within an association. In order to accept credit and debit card transactions a merchant will need to contract with an acquirer to receive funds from the cardholders issuing bank. What is an acquiring bank and what is its role in the ecommerce payment process. Acquiring banks link merchants with issuing banks.

An issuing bank is also responsible for raising or lowering the limit on the card or blocking the account if necessary. The services and products these banks provide go beyond this simple explanation but it is useful to view them through this lens. The acquiring bank also merchant bank or acquirer is the financial institution that maintains the merchants bank account. An acquiring bank also known simply as an acquirer is a bank or financial institution that processes credit or debit card payments on behalf of a merchant.

The primary purpose of an acquiring bank also known as a merchant acquirer or simply as an acquirer is to facilitate payment card transactions on behalf of merchants. Credit card association. Acquiring a bank is the key factor in the whole process.