Bank Charges In Financial Statements

The issuance of a paper bank statement rather than an on line one.

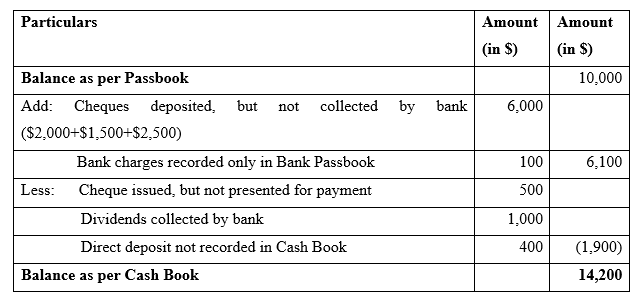

Bank charges in financial statements. In addition murrays 200y. The illustrative financial statements are contained on the odd numbered pages of this publication. While the general structure of financial statements analysis of financial statements how to perform analysis of financial statements. These charges are usually not recorded by the business until the bank provides the bank statement at the end of a month which is why balance as per bank statement may be lower than the cash book balance.

Inactivity in an account. The accounting standards issued by the institute of chartered accountants of india also confirms this view. The manual handling of transactions by a bank teller. Murray decided not to increase his monthly forecasted bank charges expense during 200y.

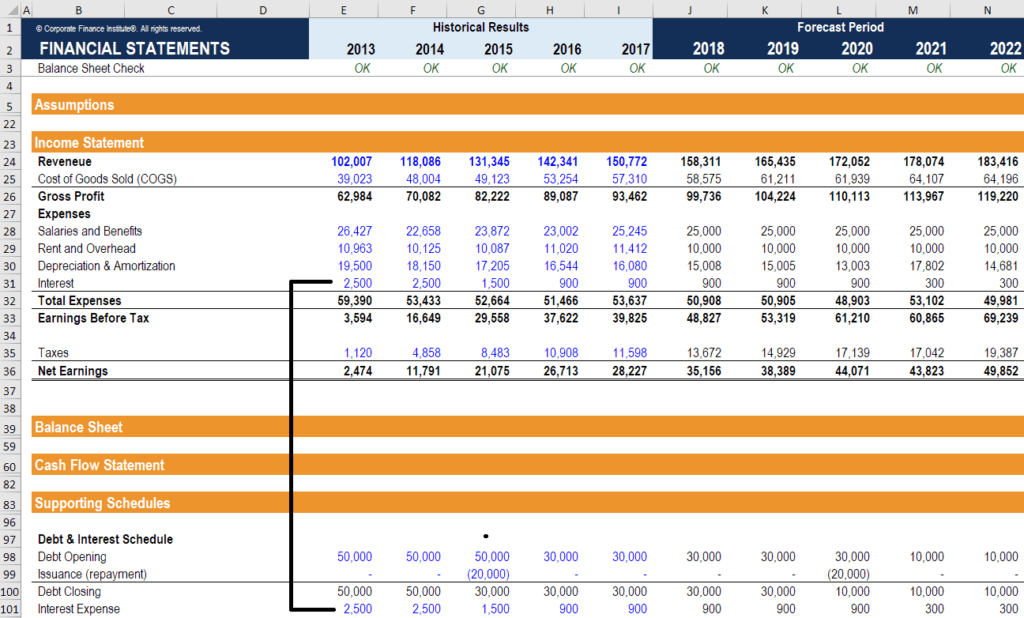

The difference needs to be eliminated by adjusting the cash book of the company before the preparation a bank reconciliation. As a result the 200y forecasted cash flow statement will show a cash outflow of 40 each month between january and december for bank charges. This guide will teach you to perform financial statement analysis of the income statement balance sheet and cash flow statement including margins ratios growth liquiditiy leverage rates of return and profitability. Discover more about the term finance charge here.

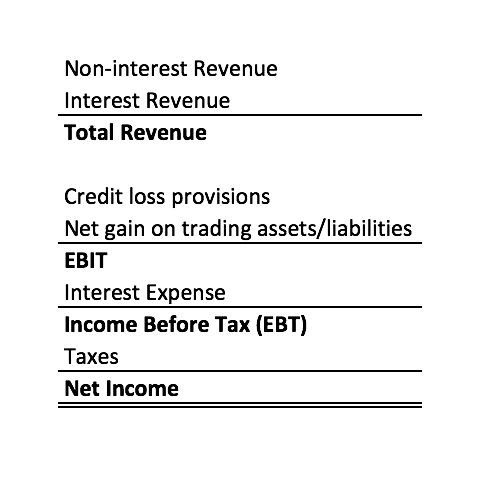

A substitute for referring to the standards and interpretations themselves. A business that incurs bank charges will usually record them as expenses as part of its monthly bank reconciliation process. The illustrative examples. In this article youll get an overview of how to analyze a banks financial statements and the key areas of focus for investors who are looking to invest in bank stocks.

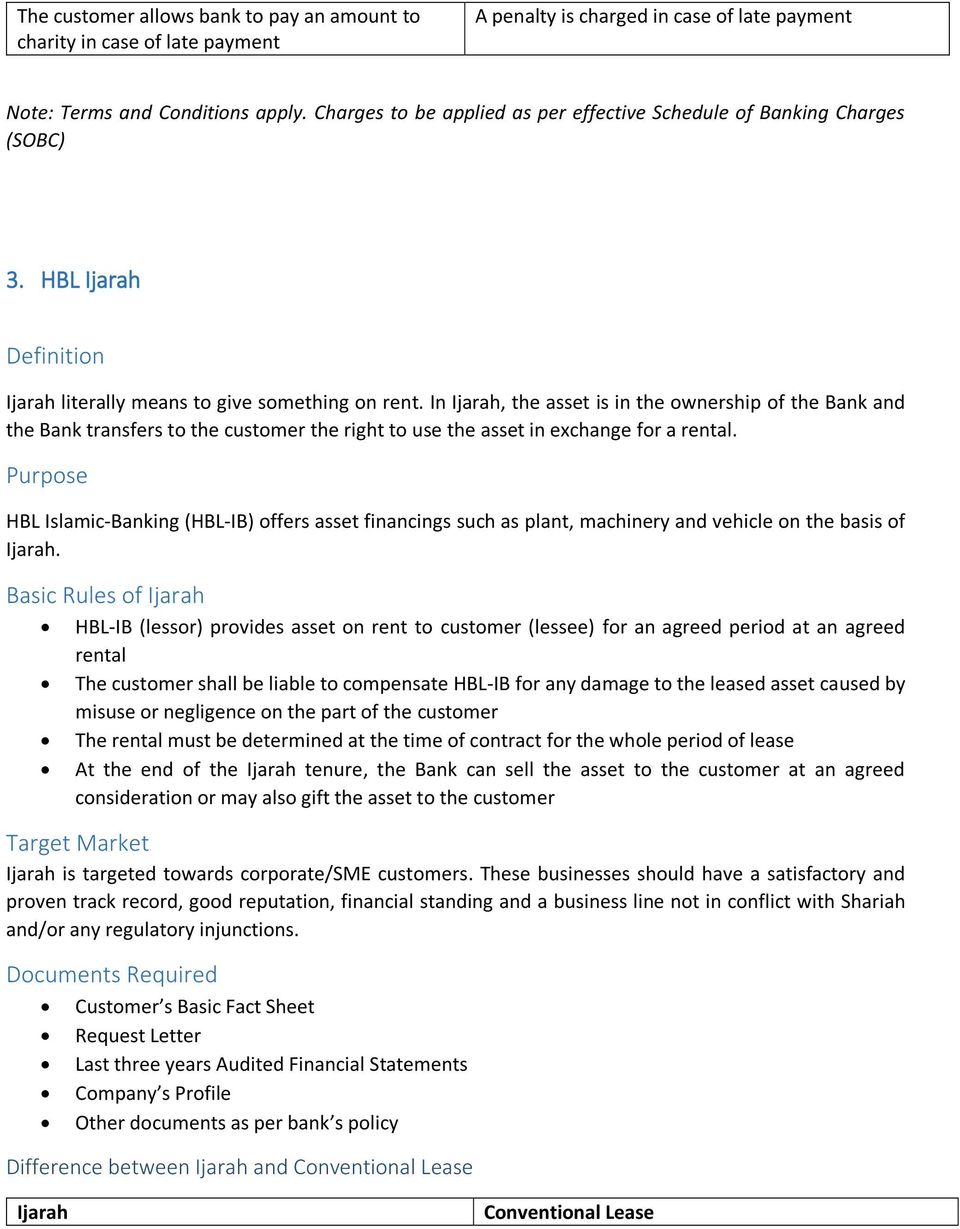

Financial statements for banks. Bank charges are charged directly to the customer account thereby reducing the bank balance shown in the bank statement. In other words murrays 200y bank charges are expected to remain at 40 per month. If the bank charges are related to borrowings then it shall be classified as other borrowing costs under finance costs or else record as other expenses in case of normal banking operations.

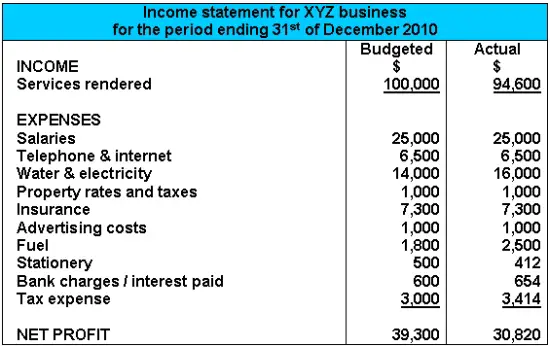

The even numbered pages contain explanatory comments and notes on the disclosure requirements of ifrs. In the budgeted income statement example above we can see that the actual profit for the period is about 8500 less than what was planned for. Bank charges can be a major source of income for a financial institution. Accordingly these illustrative financial statements should not be used as.