Types Of Commercial Banks In India

Commercial banks are of three types which are as follows.

Types of commercial banks in india. Commercial banking is also known as business banking. Through the process of accepting deposits and lending commercial banks create credit in the economy. So every bank other than rbi is either a scheduled bank or a non scheduled bankhowever on the basis of functions there are five broad categories of banks in india viz. Types of bank in india lecture 2 commercial public sector co operative rrbs and mcq duration.

Central bank rbi commercial banks development banks or development finance institutions cooperative banks and specialized banks. On the other hand cooperative banks are classified into urban and rural. Till 1955 the bank was private. In public sector banks the major stake is held by the government.

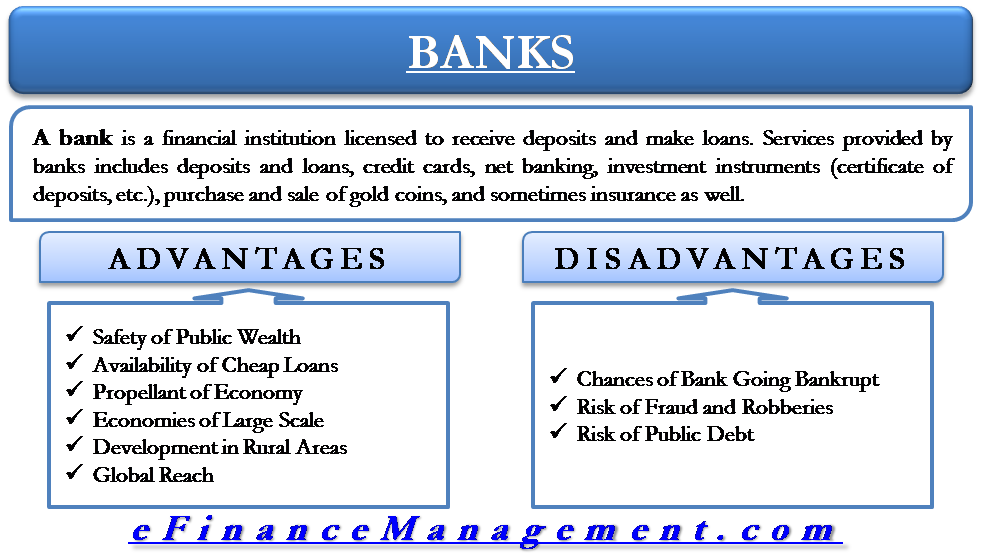

Commercial banks can be further classified into public sector banks private sector banks foreign banks and regional rural banks rrb. India reserve bank of india rbi is the central bank. Current affairs funda aptitude lr 39002 views 1750. A commercial bank is a type of financial intermediary and a type of bank.

Apart from these a fairly new addition to the structure is payments bank. Types and functions of commercial banks of india. A bank is an institution where debts usually referred to as bank deposits are commonly accepted in final settlement of other peoples debts. Refer to a type of commercial banks that are nationalized by the government of a country.

Since they are non scheduled banks they cannot borrow funds from reserve bank of india like other scheduled commercial banks. In the initial years the three presidency banks bank of bombay bank of bengal and bank of madras came together and amalgamated to form on a bank called imperial bank of india. They are to be registered as public limited companies under the indian companies act 1956. A public sector banks.

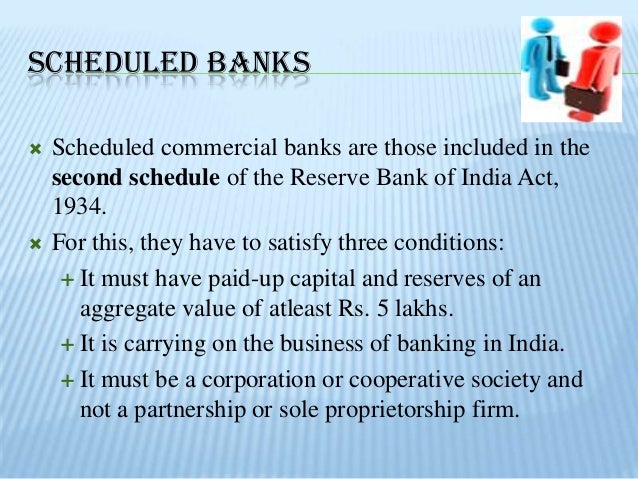

A bank dealing with general public accepting deposits from making loans to large numbers of households and firms. Commercial banks in india are usually categorized into scheduled commercial banks and unscheduled commercial banks. Some of the indian. If you are looking for classification based on functions products or services offered please refer to our article types of banks their functions.

Different types of banks in india their functions in this article we present the types of banks applicable and prevalent in india. In india public sector banks operate under the guidelines of reserve bank of india rbi which is the central bank. It is a bank that provides checking accounts savings accounts and money market accounts and that accepts time deposits.